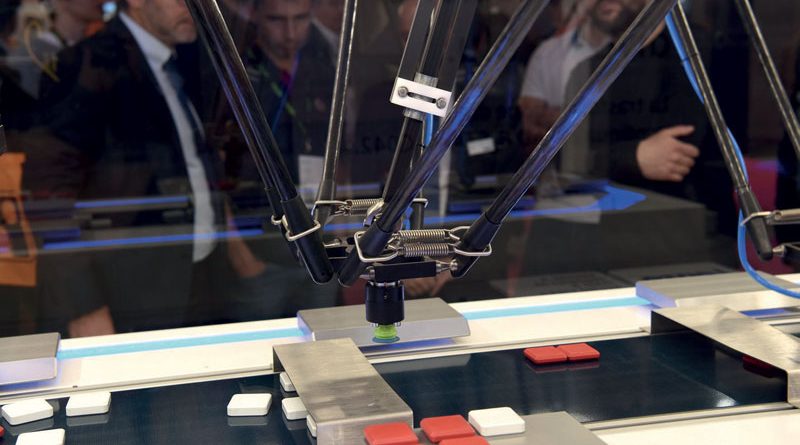

Industrial Automation in Italy is Smiling Once Again

During the opening conference of SPS Italia, entitled “The future of industry? Here and now. Technologies and skills for Italian manufacturing”, the president of ANIE Automazione, Fabrizio Scovenna, released data on the industrial automation sector in Italy. With an average overall growth of 8.4% in the main product segments – a more than satisfactory result also considering the performance of the manufacturing industry – due to the changed global situation and the Italian economy, the future seems quite uncertain.

by Fabrizio Dalle Nogare

The Italian manufacturing industry is growing only slightly; the industrial automation sector continues to grow at a steady pace, even though it is beginning to feel the effects of the uncertainties that have characterised the macroeconomic scenario for several months now.

In a nutshell, this is the picture that emerges from the official figures that have been released in the context of SPS Italia, the reference exhibition for industrial automation in Italy that has, however, confirmed the liveliness of the sector.

But let’s take a closer look at the numbers that Fabrizio Scovenna, president of ANIE Automazione, spoke about at the conference entitled “The future of industry? Here and now. Technologies and skills for Italian manufacturing” at SPS. The data contained in the Observatory of the Italian Automation Industry (we mention it later on, in the pages curated by ANIE) say that the year 2018 also confirmed the growth trend that has characterized the evolution of the sector in the last five years and have shown a more dynamic profile than the average of manufacturing.

Between 2013 and 2018, in fact, manufacturing and process industrial automation showed an average annual increase in total turnover of 7% compared to just under 2% for manufacturing as a whole.

The main product segments of the Italian automation industry showed a positive trend in 2018, with an average overall growth of 8.4%, also due to the measures contained in the Industry Plan 4.0.

Exports increase

More generally, the Italian manufacturing and process automation industry closed 2018 with a total turnover of 5.1 billion euro and an increase of 7.3% over the previous year. The dynamic trend of the sector has also been confirmed in foreign markets: direct exports, in the years between 2013 and 2018, recorded an average annual growth rate of 4%. In 2018, direct foreign sales of industrial automation technologies experienced an annual increase of 4.2%. Despite a scenario with lower potential, companies have been able, therefore, to seize growth opportunities in diversified markets.

The main destination markets for Italian industrial automation technologies in Europe are Germany, France and Spain, with a share close to 30% of the total exported. Looking at the non-European area, sector exports recorded an increase of 3.9%. Among the geographical areas that showed the greatest increase in demand were North America and East Asia.

A vital and key sector

“2018 ended with an average increase of 8.4% in the turnover of member companies in Italy in relation to the technologies and applications that ANIE Automation represents”, wrote President Scovenna in the introduction to the Observatory. “The positive influence of the incentives to digitalize continued, starting with the Industry 4.0 Plan and then becoming ‘Enterprise 4.0’, but there was a slowdown in the second half of the year, more pronounced in the last quarter, due to the scenario of national and global uncertainty, which has limited growth by a few percentage points. The sector is therefore full of vitality and is, in its own right, among the most important in the national economic scenario”.

The slowdown in the Italian economy

The scenario of uncertainty that characterized the last part of last year does not seem to have diminished even in 2019. As is well known, there are also signs of a slowdown in the European area, which is an important reference market for Italian companies.

In the most recent forecasts published by the European Commission, during the year the EU economy will show a positive growth rate but weaker than the previous year (+1.5% growth expected in 2019). Expectations are that the Italian economy will show a less dynamic trend than the European average, with an annual increase in GDP of less than one percentage point.

The forecast scenario therefore includes the risks associated with the weakening of the main components of domestic demand. Looking at Italian manufacturing, operators’ confidence shows a growing pessimism, in line with the deterioration of the economic situation that emerged in the latest months. A highly critical element is represented by a sharp slowdown in investment, which could severely limit the growth potential of Italian industry in the current year.

Of particular concern is the reduction in investments with a higher technological content, which in the previous two years had made a central contribution to the recovery. Industrial investments are, in fact, an essential growth engine for the Italian economy, which traditionally has a high degree of specialisation in manufacturing.

What happens if investments drop?

Such signs, however, were also seen in 2018, when the Italian economy maintained a positive trend, but less dynamic than the trends recorded in the previous two years and with signs of braking concentrated at the end of the year.

As stated in the Observatory published by ANIE Automazione, “foreign demand has been affected by the slowdown in global trade and by a more uncertain macroeconomic profile in the main reference markets. Looking at domestic demand, total investment continued to make an important contribution to the growth of the Italian economy, at least until the first part of the year. In the second half of 2018, the pace of investment growth slowed, as a result of a more uncertain scenario. These trends have also affected the component relating to machinery and equipment, which in 2017 had played a leading role in the recovery of the Italian economy”.

“A less favourable macroeconomic context was reflected in the performance of the manufacturing industry, which at the end of the year showed a weakening of activity levels and more diversified trends at sector level than in the recent past. Among the most dynamic sectors, the pharmaceutical industry is confirmed, in a context of repositioning in the global supply chains.

The mechanical industry maintained a positive trend, although there were signs of a slowdown in the second half of the year as a result of the weaker profile of investments. The automotive industry was characterised by contrasting indications, affected, among other things, by the drop in registrations in the domestic market”.